Questions? We are here to help!

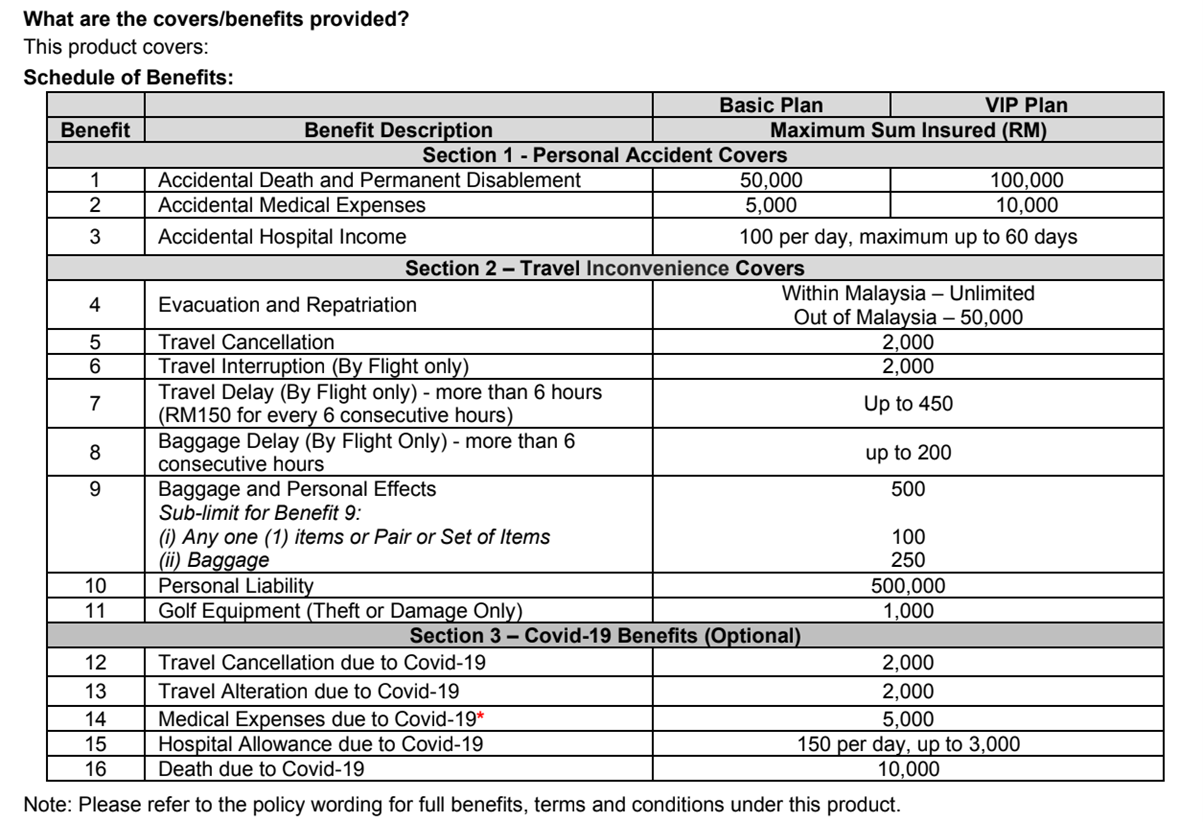

What exactly does the policy cover?

Coverage (age 30 days old to 80 years old):

It is hereby declared and agreed that the Table of Benefit as stated in the Group Personal Accident Insurance Policy Wording is amended to read as follows and not otherwise stated:-

BENEFIT A – Accidental Death and Permanent Disablement

Other Benefits

Who is the insurance provider?

Insurance provider is Zurich General Insurance Company Berhad. The product sold is Z-Travel Policy(Domestic/ Inbound).

How does the claim process work?

At Senang, we are committed in ensuring that your insurance claims is made easy to ensure you focus on the important things in life. The insurance claim work based on pay and claim. Documentation needed for claims are:

- Completed Claim Form- To be done via email to Senang (melisa.tan@senangpks.com.my)

- Police Report

- Medical report (not required for claims below RM250.00)

- Medical Certificates

- Copy of identification card (both sides)

- Original receipts/bills

- If it’s Permanent Disablement – Specialists’ report

- Copy of Post Mortem Report

- Copy of Death Certificate

- Copy of burial/cremation certificate

- Letters of Administration if nomination not done

- Copy of identity card of the beneficiary

- For Motor accidents – Copy of Valid International driving license

- E-Payment Form

What is the emergency hotline number?

24/7 Medical & Travel Assistance Services: 603-78415630

Do I get an official receipt of the insurance policy?

You will get an admin debit note from WAHDAH.

How do I cancel the policy if I bought it accidently?

You're required to drop us an email that explain the reason for cancellation. The policy can only be cancelled before the trip commence.

Conditions:

It is hereby declared and agreed that the following Conditions shall be incorporated into the Group Personal Accident Insurance Policy Wording: -

Claims Payment :

In the event of claims, We shall pay to the respective Insured Person except in the event of death, pay to the Insured Person’s next of kin or legal personal representative the sum insured stated in this Policy Schedule.

It is hereby declared and agreed that the following Conditions as stated in the Group Personal Accident Insurance Policy Wording are amended to read as follows and not otherwise stated:-

Please drop an email to melisa.tan@senangpks.com.my to ensure a smooth claiming process.

Reference / Source :

ADDITIONAL QUESTIONS

1. What is this product about?

This is a domestic travel product that covers you while you are travelling within Malaysia, and it is available in both Insurance & Takaful.

2. What are the criteria to be covered?

a. You must be a Malaysian, or non-Malaysian who has a permanent resident status, valid work permit, valid student permit, entry permit or Malaysia My Second Home (MM2H) status.

b. age limits (all ages refer to the age of your next birthday):

• Individual Cover, Individual & Spouse Cover, Family Cover – 30 days old to 80 years old. For Children insured/covered under individual or family cover, the policy/ certificate must be purchased/participated in by the parents/legal guardian.

• Child Cover – 30 days old to 17 years old, or 23 years old if studying as a full-time student at the commencement of the journey.

3. Is there a maximum travel duration apply?

Yes, the journey shall not exceed 60 days.

4. Does this product subject to SST (6%)?

Yes, this product is subject to 6% SST.

5. Can my company purchase/participate in a group travel policy/ certificate?

Yes. This product is available for both individual and group.

Individual - individuals can purchase/participate in the policy/ certificate for himself/herself or extend the cover for his/her spouse and children.

Group - company/association can purchase/participate in the policy/ certificate for their employees/members. However, it is important to take note that the person/entity purchasing/participating in the policy/ certificate is the policyholder/certificate holder. Therefore, in the event of claims, claims will be payable to the policyholder/ certificate holder.

6. Can I form a group of friends to purchase/participate in a group travel policy/ certificate?

No. You cannot purchase/participate in a group policy/ certificate with your friends if there is no insurable interest/permissible takaful interest between you and the other insured persons/ persons covered.

7. What are the criteria to purchase/participate in a family plan policy/ certificate?

A family plan can be purchased/participated in to cover you, one of your legal spouses and your accompanying child(ren) who must be between 30 days old to 17 years old, or 23 years old if studying as a full-time student at the commencement of the journey. If your child(ren) has exceeded the child’s maximum age as mentioned above, he/she must purchase/participate in an individual policy/ certificate. If your spouse is not travelling together, you can still purchase /participate in a family plan to cover yourself and your child(ren).

8. Is there a maximum number of family member that can apply for the family plan?

There is no limit on the number of family members that can apply on family plan. However, the maximum limits payable under the family plan is 300% of the limit and sub-limit stated in the Schedule of Benefits, except for the following benefits in which the limits remain as per the insured person/ person covered.

• BENEFIT 1 & 3– Accidental Death & Permanent Disablement & Accidental Hospital Income

• BENEFIT 15 & 16 - Hospital Allowance & Death due to Covid-19 (if you have selected this add-on benefits)

9. Can I extend my policy/ certificate if I have decided to extend my stay during my trip?

Once you have departed for your trip, the policy/ certificate cannot be amended/extended.

10. I have pre-booked a cruise trip during my holiday to Penang. Will I be covered during this cruise tour?

We do cover you when you are in your cruise journey. Nevertheless, as this is not solely a cruise cover, we do not cover Travel Interruption, Travel Delay, and Baggage Delay during your cruise journey.

11. Does this product cover hiking, trekking, rock climbing, and scuba diving?

Mountaineering or any activity above three thousand (3,000) meters in height, rock climbing, and any underwater activities exceeding fifty (50) meters in depth are excluded from this policy/ certificate.

12. I’m traveling for 5 days (i.e. from 1st July to 5th July) and I will return home at midnight. As it is possible for me to return home after 12am on 5th July, should I buy/participate in the policy/ certificate until 6th July?

Yes, as the policy/ certificate covers you until you return your home or place of business, it is advisable for you to purchase/participate in the policy/ certificate until the date when you expect to return home or place of business.

13. I have purchased/participated in a family plan. Can my wife and I make our nominations separately?

If the policy/certificate is purchased/participated in by you, you will be the policyholder/ certificate holder of the policy/ certificate and only the policyholder/ certificate holder have the sole right to nominate. However, if your wife wishes to nominate, it is advisable to purchase/participate in an individual policy/ certificate, instead of family plan.

14. Can I cancel my policy/ certificate?

You may cancel your policy/ certificate by giving a written notice to us, but no premium/ contribution will be returned.

Section B: Covid-19 Benefit Related Questions

1. What is this benefit about?

This is an optional add-on benefit, it provides coverage for Covid-19 related incidents i.e., travel cancellation/alteration, medical expenses, hospital allowance and death due to Covid-19.

2. Do I have to pay/make any additional premium/ contribution?

Yes, the cover is subject to additional premium/ contribution. Please refer to the premium/ contribution table in the PDS.

3. Is this a standalone product or must it be purchased/participated in together with the base policy/ certificate?

This is not a standalone product. The Covid-19 add-on must be purchased/participated in together with the base policy/ certificate.

4. Will claims under Covid-19 benefits reduce any of the base policy/certificate benefit limit?

No, any claim from Covid-19 benefit will not reduce any of the base policy/ certificate benefit limit.

5. If I have not received any Covid-19 vaccinations, will I be covered?

No, you will not be covered if you have not received any of the approved Covid-19 vaccination(s), except if you are unable to receive the vaccine due to medical conditions, or you are a child below the age of eighteen (18) years old in Malaysia.

6. Can I claim both Travel Cancellation and Travel Alteration benefits due to Covid-19?

No, you can only claim from either travel cancellation or travel alteration due to Covid-19, but not both. The entire policy/ certificate will be terminated once a claim has been paid for either travel cancellation/ alteration due to Covid-19.

7. Is there a cut-off date I need to purchase/participate in the Covid-19 add-on?

Yes, to be eligible for Travel Cancellation due to Covid-19 and(or) Travel Alteration due to Covid-19 benefits, you must purchase/participate in the add-on for at least seven (7) days prior to the commencement of your journey.

8. What happens if I travel to Sabah and unable to return to Peninsular Malaysia due to Covid-19 and require self- quarantine?

We do not cover any costs related to quarantine.

9. What are the special exclusions under this benefit?

Special exclusions applicable to Covid-19 benefits

• Covid-19 infection that you have reasonable knowledge of prior to the Period of Insurance/ Takaful, but this is not applicable if you have been fully recovered from Covid-19 and no longer receive treatment prior to the Period of Insurance/ Takaful of the Policy/ Certificate.

• If you’re travelling against physician’s advice.

• Any loss resulting from border closures, travel ban or other government orders.

• You have not had the approved Covid-19 vaccination(s).

Section C: Claims Related Questions

1. How do I make a claim?

You must notify all claims to us within 24 hours, but not later than 30 days after the loss or damage. You cansubmit your claims online at www.zurich.com.myas below and/or submit the original claims documents to:-

Zurich HQ.

Zurich General Insurance Malaysia Berhad

Attention to: General Claims Department – AHWC

Level 23A, Mercu 3, No.3, Jalan Bangsar, KL Eco City

59200 Kuala Lumpur, Malaysia

2. Who do I contact for an emergency assistance on evacuation and repatriation while on my Journey?

Please call our 24 Hour, 7 Days Travel Assistance Helpline at +603 7841 5630.

3. If multiple individuals (e.g., family members) are sharing the same baggage which is checked-in with the common carrier, and the baggage is delayed for more than 6 hours, can all of them make a claim under Baggage Delay?

If multiple Insured Persons/ Persons Covered, regardless friends or family members, share the same baggage which is checked-in with the Common Carrier, we will only accept claim from 1 Insured Person/ Person Covered. This applies to delay, lost, stolen or damage. Reference can be made to policy/ certificate wording -

Special Conditions applicable to Benefit 8

4. I am going for hiking/trekking in Gunung Kinabalu, will I be covered during my hiking/trekking activities?

Mountaineering or any activity above three thousand (3,000) meters height is excluded from this policy/ certificate.

5. If my checked-in baggage is damaged by the common carrier and they have compensated me on the damages,can I make a claim on my policy/ certificate?

We do not cover any loss that is payable by any other sources. However, we will pay the difference between the amount payable from any other source and the actual loss you have incurred.

Categories

- All

- Add Ons

- Bookings

- Cancellations & Refund

- Claim & Accidents

- Document Requirements

- Late Return

- Others

- Protection & Coverage

- Security Deposit

- Subscription

- Vehicle Pickup & Return Policy

- WaCash

- WAHDAH Benefits

- WaPoints

- Charges & Fees

- Shuttle Singapore

- WaClub

- Compensation

- JB Sentral Pick Up & Drop Off

- Klook

Related Articles

-

WaClub

4 days, 23 hours ago

-

WaClub

5 days ago

-

Klook

2 weeks, 5 days ago

-

Klook

2 weeks, 5 days ago

-

Klook

2 weeks, 5 days ago

EN

EN Bahasa Malaysia

Bahasa Malaysia Bahasa Indonesia

Bahasa Indonesia